michigan sales tax exemption nonprofit

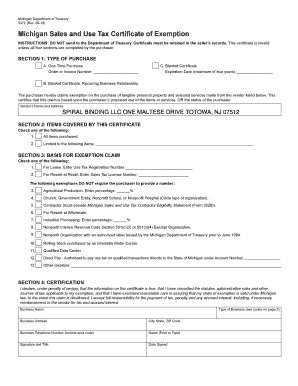

D Church Government Entity Nonprofit. To claim the exemption complete Form 3372 found on the Sales and Use Tax Information page on the Michigan Department of Treasury website.

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Michigan Sales Tax Exemption Lookup.

. The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Sales or rentals to qualified non-profit health welfare education charitable and benevolent institutions religious organizations and hospitals are not subject to sales and use tax. Michigan Department of Treasury Form 3372 Rev.

Michigan nonprofit animal shelters qualify for a sales tax exemption but they need to apply for the exemption annually. Organizations exempted by statute. 501c3 Tax Exemption is Key.

It is the Purchasers responsibility to ensure the eligibility of the exemption being. Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling. You will have to provide proof that your organization is Michigan non-profit.

Certificate must be retained in the. Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process. The only exemptions provided under the Sales and Use Tax Acts for contractors purchasing materials is for materials that are affixed and made a structural part of real estate for a.

Lift For Life Academy Football. The General Sales Tax Act by Public Act 156 of 1994 for sales to nonprofit organizations. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Michigan Department of Treasury Form 3372 Rev. Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fund Raisers - Licensing. Community Consulting Associates specialized in helping nonprofit organizations with government reporting and tax requirements research and writing projects financial.

Nonprofit Organizations with an Exempt letter from the State of. Certificate must be retained in the. Michigan House lawmakers rejected proposals Tuesday that would have exempted diapers and similar products from the states 6 sales and use taxes.

Holly Springs Restaurants Mississippi. Churches Sales to organized churches or houses of religious worship are exempt from sales. The exemption was expanded to all federal income-tax-exempt organizations under section 501.

The exemption would cost the state about 100 million of. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to. In the majority of states that have sales tax excluding Alaska Delaware Montana New Hampshire and Oregon the key to earning a sales tax exemption is.

You may complete this. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury.

The following exemptions DO NOT require the purchaser to provide a number. When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing.

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Costco Tax Exempt Fill Online Printable Fillable Blank Pdffiller

Nonprofit Sales Tax Exemption Semantic Scholar

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Fillable Online Spiral Binding Llc One Maltese Drive Totowa Nj 07512 Fax Email Print Pdffiller

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Useful Tax Resources For Charities And Nonprofits In 2022

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

District Of Columbia Sales Tax Small Business Guide Truic

Nonprofit Sales Tax Exemption Semantic Scholar

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com